At SNRAJ INVESTMENT SERVICES PRIVATE LIMITED, we focus on our client’s investment plans with proper guidance and good selected schemes. Usually, when people select a scheme themselves, they do so based on its performance. They don’t consider that past performances may not be sustained. Evaluation of schemes is a function of various attributes of the schemes, e.g. scheme objective, investment universe, the risks that the fund is taking, etc. We at SNRAJ INVESTMENT SERVICES PRIVATE LIMITED trained for such a job. Secondly, more important than investing in the best scheme, it’s important to invest in a scheme most appropriate or suitable to the investor’s current situation. Correct sheme selection and continous monitoring with required re-balancing approach help our clients to reach their financial goals on time.

What are Mutual Funds?

A Mutual Fund is an investment, just like a Fixed Deposit or Post Office Term Deposit. Let us assume you

are an investor who does not have experience in managing money and taking investment decisions, but

you are looking for better returns. You need professional help to manage your money and receive good

returns. So, all you need to do is invest in Mutual Funds. If you invest in Mutual Funds on a monthly

basis it is called SIP (Systematic Investment Plan).

How mutual funds work?

A Mutual Fund collecting money from investors and invest in relative secuities like Equity / Bond /

Money Market Instruments. Let us say 10000 investors have each invested Rs. 10000 in the fund. So the

total amount collected is Rs. 10 crores. This amount is then managed by a professional fund manager

who invests it by purchasing shares and bonds depending on the type of Mutual Fund. The profits from

the investments are shared by all the investors.

How are returns calculated?

When an investor buys a Mutual Fund, they are provided with units. The cost price for each unit is called

NAV (or Net Asset Value). For example, if you have purchased a Mutual Fund for Rs. 10000 at a price

(NAV) of 100, then you will receive 100 units. One year later, the shares invested by the mutual funds

have increased in value so the NAV increases to say 105. You can now sell your units at NAV of 105 for a

total value of 100 x 105 = Rs. 10500. So your profit is Rs. 500.

“A Goal without a plan is just a dream.”

Every individual has life goals that he needs to reach in the short term or long term. Calculating and investing regularly to be able to reach that financial goal is called goal-based investing.

For example, if you wish to retire at your age of 45 (which is 20 years away) and its considered a long term goal and you have 20 years to achieve your goal (target amount for your retirement)

Achieve more by less

Power of compounding - the beauty of money is that it compounds because not only your principal but even the

income earned by your investment generates income. That is why equity funds are able to give returns in excess of

17-18 % annualized over a longer period of time. The earlier you start the better. For example, if you started a mutual

fund SIP with a monthly investment of Rs.10,000 for a 20 year period and earned 18 % returns then at the end of 20

years you would have invested Rs.24 lakhs but your portfolio will be worth Rs.2.35 crore. And all this with a monthly

outlay of just Rs.10,000! Now if you started 10 years later, you will have only 10 years of investing left with you. In

that case, hold your breath, you will have to invest a whopping Rs.70,000 per month to reach the same target. That is

why in any savings plan, you can achieve more through your investments if you start off early.

Any goal in your life is possible with proper planning and execution. We are here to help you to reach your goals…

ELSS funds are diversified equity funds with a lock-in period of 3 years. Offer tax deduction of up to 1.5 lakhs under Section 80C of the Income Tax Act, 1961. Provide double benefit of tax saving and capital gains

Income tax benefit Investments made in ELSS schemes are eligible for deduction from taxable income

under Section 80C of the Income Tax Act.

Up to Rs 1.5 lakhs invested in ELSS funds in a year is eligible for deduction under Section 80C. No tax is

levied when you redeem your investment after the lock-in period.

Since ELSS funds have more than 65% of their corpus invested in stocks, they enjoy the exemption from

tax on long-term capital gains as is the case with any other equity fund. The dividend income is also

tax-free.

Lower lock-in period The lock-in period is only three years, the shortest among all tax-saving options

under Section 80C. You cannot redeem or switch to another option during this period. In the case of

SIPs, each installment is treated as a separate investment and will have a three-year lock-in period.

Tax-free Dividends/Capital Gains Dividends declared under the ELSS scheme during the investment

period are tax-free. The profits on the sale of ELSS units are treated as long-term capital gains, and are

not subject to tax.

Higher return potential ELSS funds invest a large part of the fund in equity, which despite short-term

volatility has the potential to build wealth over the long term.

Minimum Monthly Investment Unlike regular equity schemes, the ELSS funds have a lower investment

threshold of Rs 500. You can invest a large amount at one go, but the best way to invest in equityoriented

instruments is through regular monthly driblets called SIPs.

Growth, Dividend & Reinvestment The dividend is only a profit-booking exercise since a fund's NAV

reduces by the amount the investor receives as dividend. In the growth option, the amount remains

invested for the entire tenure.

The dividend option provides a periodic income to the investor, though there is no obligation on the

part of the mutual fund to declare a dividend or maintain its payout ratio year after year. The growth

option has the potential to generate higher returns. Your choice should depend on your needs and risk

appetite. Avoid the dividend reinvestment option because you will find it difficult to exit the fund

completely. There will always be some units that have not completed the lock-in period.

A SIP is a disciplined investment plan and helps reduce susceptibility to market fluctuations. It is a

powerful tool that helps you preserve capital and also translates into substantial wealth creation in the

long run.

A SIP is an excellent tool for investors to build wealth. There is no need for a one-time lump sum investment.

A regular investment pattern helps build discipline in investors. You can go for a SIP according to your goal - marriage of children, their education needs or your retirement corpus. The 'rupee cost averaging'

makes the market fluctuations work for you, and reduces the risk of investing all your money just

before a market downturn.

SIP investments can help you reach your financial goals by taking advantage of rupee cost averaging,

and growing your investments with compounded benefits.

Rupee cost averaging works best with investments that tend to fluctuate in price regularly. So a SIP can

be most effective when used in buying equity-based funds.

SIP is a simple, convenient and affordable way to invest for your future. With as little as 1,000 every month, it’s an effective method to invest in the growth potential of Mutual Funds.

Advantages of SIP

1. Rupee Cost Averaging

2. Regular Investments

3. Power Of Compounding

4. No need to time the market

5. Automated (ECS)

6. Flexibility to invest small amounts every month

Non-Resident Indian (NRI) An Indian citizen or a foreign citizen of Indian origin who has stayed abroad for employment/carrying out business or vocation for 182 days or more or under circumstances indicating an intention for an unknown duration of stay abroad is a Non-Resident Indian (NRI). Those who stay abroad on business visits, for medical treatment, study or such other purposes, which do not indicate an intention to stay there for an indefinite period, are not considered as NRIs.

Foreign Institutional Investor (FII)?

FII means an institution established or incorporated outside India , which proposes to make investments in Indian securities and is registered with SEBI.

Can an NRI maintain a bank account in India?

Yes. NRIs can maintain bank accounts in rupees as well as in foreign currency. However, accounts in foreign currencies can be maintained with authorized dealers/ banks only.

1. NRE: Non-Resident (External) Rupee Account

2. NRO: Non-Resident (Ordinary) Rupee Account

3. FCNR- B: Foreign Currency (Non -Resident)

What are NRE and NRO accounts?

Non-Resident (External) Rupee (NRE) account is a rupee account from which funds are freely repatriable. It can be opened with either funds remitted from abroad or local funds maintained in NRE/ FCNR accounts, which can be remitted abroad. The deposits can be used for all legitimate purposes. The balance in the account is freely repatriable. Interest credited to the NRE accounts is exempt from tax in the hands of the NRI.

Non-Resident Ordinary Rupee (NRO) account is a rupee account and can be opened with funds either remitted from abroad or generated in India. The amounts in such an account are generally non-repatriable. However, funds in NRO accounts can be remitted abroad subject to/as per various directives in force at the time of repatriation. More details can be found on the Reserve Bank of India (RBI) website www.rbi.org.in

Can NRIs & FIIs invest in mutual funds in India?

Yes. NRIs (except from USA and Canada) and FIIs can invest in mutual funds in India.

Real wealth is created when our returns over and above inflation. When compared to Gold, or FD’s, it has been seen that only equities have the potential to deliver inflation beating returns and thus can assist you in long term wealth creation.

Equities as a long term investment avenue and mutual funds are the perfect tool for channelizing our money into the equities market.

It doesn’t matter whether you are an aggressive or a conservative investor. Mutual funds help create wealth for your long- and mid-term goals.

SIP - Regular Savings

A systematic investment plan (SIP) allows an investor to invest a specific amount in an MF scheme of his or her choice over a specific period. SIPs are most effective in equity schemes, as they are a more volatile asset class than debt. SIPs help in regular savings as well as in riding on the volatility of the equity market. Over long periods, SIPs help lower the average purchase price of units which will helo higher returns.

Make your Wealth grow with equity Mutual Funds

Schemes that invest in equity shares of companies are called equity MF schemes. As an asset class, equities have the potential of providing high returns with an acceptable levels of risk, but the challenge lies in understanding the behavior of equity markets over a long period of time not a year or three, but at least over a decade or more.

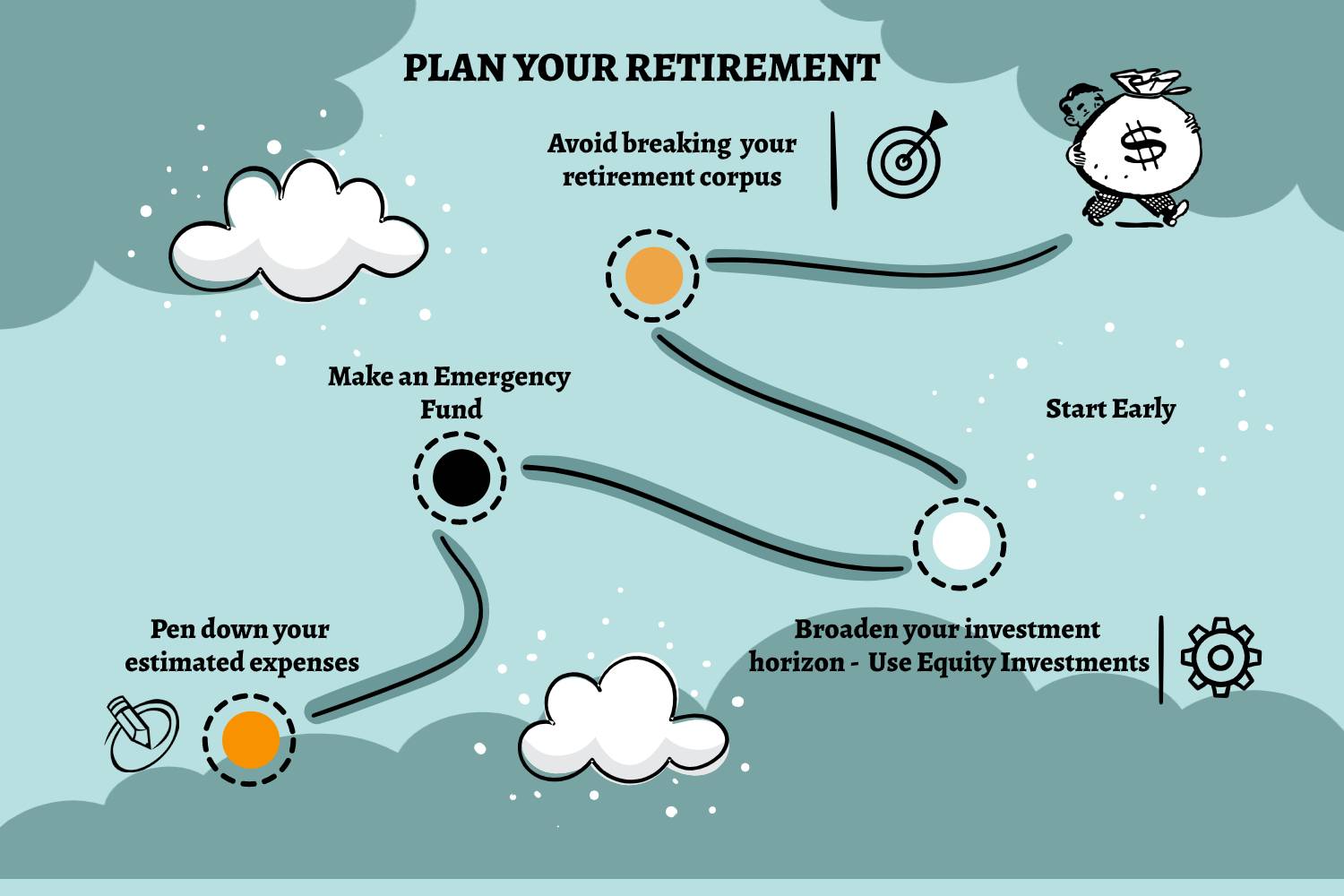

Retirement planning is a complex but a very important topic, especially in today's context as our country is going through a process of economic and social transformation. Some of these changes are:-

One of the fundamental tenets of finance is the principle of "time value of money". In simple terms, money loses value over time.

While there are several products available in the market for retirement, like Public Provident Fund, New Pension Scheme and pension plans offered by insurance companies, each with their own merits, mutual funds are very effective instruments for retirement planning. There are a number of benefits of retirement planning through Mutual funds Systematic Investment Plans (SIP):-

Mutual funds are more tax efficient than some of the other products (e.g. pension plans). Long term capital gains for equity mutual funds are tax exempt. Income from pension plans, on the other hand, is taxable

Mutual Funds are very flexible instruments. There are no restrictions and penalties on regular SIP payments and withdrawals, unlike pension plan premiums or PPF

For the smart investor, mutual funds offer more choices and transparency. You can select products based on your risk profile, track record, and fund objectives

We are very happy to assist you to achieve your retirement planning. Call us today / send SMS to initiate your retirement planning.

As a parent, we all want the best for our children and for them to have the best possible life.

The best way to do that is to provide them with a good education.

Everyone will agree the best asset we can give to our child in order to secure their future is a good education. As a parent we always want to see our child happy, healthy and to have better opportunities especially if we ourselves didn’t have them during those early years of life.

In today's world, we can fulfil all such desires only by providing the child with a good education.

But, providing a child with good education is not easy as it used to be earlier. Today, the scenario is different due to the following facts:

‘Expenses are shooting up’ the costs of sending a child to school in India have risen by 160% in the last 8 years. The average annual income of fairly well-off parents has not risen by more than 30% in the same period.

Apart from the pre-college expenses, the higher education expenses are increasing day by day due to the increasing competition. Now-a-days students have a number of choices for higher education. Specialized courses have higher fees structure like - Courses in the medical field usually involve higher costs than others.

In today’s world education has become more globalised with demand for more degrees. So if one is planning for overseas education than the expense also involves factors like the length of study, stay and the choice of country and university.

Apart from all the above expenses, there are even expenses involved with providing child with extracurricular activities, electronic gadgets and other related expenses.

Even after knowing the above facts it’s quite shocking that many of us neglect the importance of child education planning and result is that we are under the mountains of loans at the time of need, which affects the savings that we have made for our retirement and also our personal financial budget for family. Some parents aren't even aware of its severity until it's too late - when their children have only a few years left until graduation! Others may hope that their kids are "smart" and will earn plenty of scholarships to pay the costs.

Right now, most Indians are planning for their child’s education in an unstructured way. They just put some random amount in some generic financial product, without understanding how much would they require at the end, when the goal actually arrives.

The sooner you start investing for your child's education, the better. As with any other investment goal, time is your best friend!

We are very happy to assist you to achieve your Kids higher education planning.

Call us today to initiate your investment for your Kids higher education.

The purpose of Children's Future Planning is to create a corpus for foreseeable expenditures such as those on higher education and wedding, and to provide for an adequate security cover during their growing years.

But, providing a child with good education is not easy as it used to be earlier. Today, the scenario is different due to the following facts:

For parents who want to save for their children’s marriage, mutual fund is the best investment option. Since children’s marriage is a long term financial objective, like retirement planning.

Equity as an asset class provides the best returns over a long time horizon. As such equity oriented mutual funds are the best investment options for long term objectives

Meeting children's needs is an obligation for parents in India. With proper and diversified invetment in Mutual Fund, the needs can be met without much stress.

Investors need to have a disciplined approach to investing to generate enough wealth for their children’s marriage. Systematic investment plans (SIPs) ensure that you stay on track with your investments.

Like most parents, you might be saving regularly to ensure a safe tomorrow for your child. However, savings alone is no longer enough.

We are very happy to assist you to achieve your children's marriage planning.

Call us today to initiate your wealth generation for your children's marriage.